New York

CNN

—

Most of the year, people come to Jackson Hole, Wyoming to ski, fly fish, or enjoy the area’s vast natural beauty. But for three days in late August, the valley near Grand Teton National Park turns into Woodstock for economists.

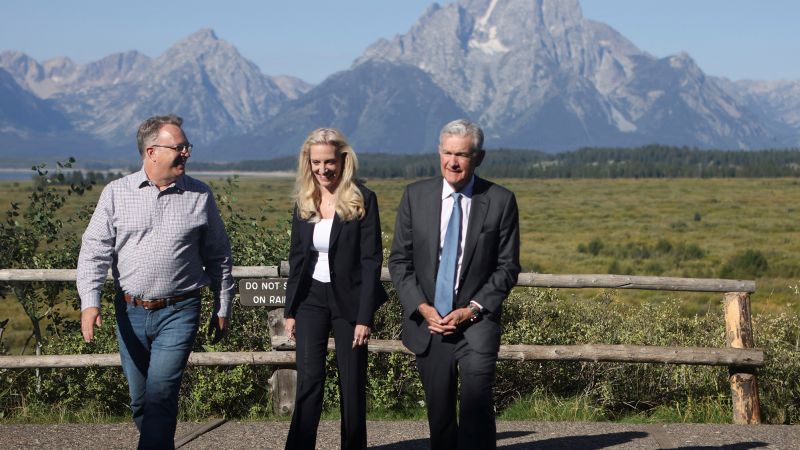

There, top economists from around the world rub shoulders with reporters and investors for clues about their economic outlook. But instead of the Grateful Dead, the head of the festival, which runs from August 24-26, is Federal Reserve Chairman Jerome Powell (who admits he’s a Deadhead).

Powell took the stage Friday morning at the 46th Kansas City Fed Festival, formally known as the Jackson Hole Economic Symposium.

Inflation has slowed significantly since last year’s Jackson Hole conference, and there are glimmers of a cooling labor market. But it is uncertain How long will it last without further rate hikes? The central bank’s actions so far have not been enough to curb inflation.

On the other hand, because there are lags between when the central bank acts and when its actions are felt throughout the economy, there is a risk that the central bank will inflict more pain than is necessary to get inflation to the bank’s 2% target. Raises interest rates too high.

In their most recent period At the meeting in July, central bank officials again said that the risks of not raising interest rates enough to fight inflation outweighed the risks of inadvertently raising rates too high; So, they opted for a quarter point rate hike. That increase came after central bankers voted to keep rates steady in June, the first pause since they began raising rates in the spring of 2022.

Traders hope the central bank will pause again at next month’s meeting CME FedWatch tool. But there is little consensus about the central bank’s game plan after September.

If history is any indication, Powell’s speech could lead to major policy changes, said Michael Cahill, vice president of foreign exchange research at Goldman Sachs.

Last year’s Jackson Hole conference was notable because it was the first time in two years that economists met in person. Powell used his keynote speech to warn that Fed officials are going to be unapologetic in their fight against inflation, even if it means “pain” to families and businesses. Two three-quarter-point rate hikes followed the Fed’s meetings after Jackson Hole.

In recent history, many notable speeches have been delivered from the Jackson Hole Convention.

In 2010, for example, then-Fed Chairman Ben Bernanke used his time to lay out “policy options for further easing.” “This was widely seen as a signal of further quantitative easing,” he said. Quantitative easing, or QE, is when the central bank buys bonds in an attempt to lower interest rates to stimulate the economy.

After Bernanke’s Jackson Hole speech, he unleashed a new phase of bond-buying, now known as QE2. Later, in his 2012 Jackson Hole speech, Bernanke said labor market stagnation was a “serious concern.” He also said the central bank’s QE2 had shown positive net benefits. Shortly thereafter the Fed introduced QE3.

In 2016, then-Fed Chair Janet Yellen, the current Treasury secretary, used her Jackson Hole address to prepare markets for more rate hikes, saying she believed “the case for an increase in the federal funds rate has strengthened in recent months.” Then, beginning in December 2016, roughly through 2018. The central bank hiked rates every three meetings.

As well as a music festival lineup, Jackson Hole has other headliners and smaller-scale events.

Indeed, “Fed speakers are not always very popular,” Cahill told CNN.

Bernanke’s speech from Jackson Hole wasn’t the only headline in 2012. Michael Woodford, an economics professor at Columbia University, criticized the Fed’s reluctance to keep rates low to help economic growth. His speech and the His research findings did not go unnoticed by the central bank.

The December 2012 post-meeting policy statement noted that Fed officials expected “this exceptionally low bound for the federal funds rate to remain appropriate as long as the unemployment rate remains above 6.5%.”

“The change is intended to help the public better understand the Fed’s decision-making process in response to changes in economic conditions,” New York Fed President John Williams said in 2013. Column for VoxEU. At the time of publication, Williams served as president of the San Francisco Fed.

Central bankers outside the US also used their time on the Jackson Hole platform to signal policy changes.

Mario Draghi, former president of the European Central Bank, noted in his remarks at Jackson Hole in 2014 that inflation levels were too low for markets to price. The comments were widely seen as the starting point for more QE, even after the ECB cut rates to negative territory, Cahill said.

Columnist for the Financial Times Draghi “definitely stole the show this year,” going so far as to say [at Jackson Hole].”

Whatever comes of this year’s conference, it’s clear that what happens in Jackson Hole doesn’t stay in Jackson Hole.

This story was updated from its original version Friday at 8 a.m. ET